Are you confused about your credit score? Well you are not alone. A lot of Americans are actually having a hard time understanding this score. In fact, based on a news release from ConsumerFed.org, ⅖ of consumers are unaware that mortgage lenders and credit card issuers refer to this number before making decisions. At least, ⅖ of the respondents of the survey initiated by VantageScore Solutions and the Consumer Federation of America. The same number of respondents also think that age and marital status are factors to consider when calculating their credit score.

Obviously, there is a need to teach consumers about this financial topic and why don’t we start with the different credit score ranges? Now you may be wondering, why are we concentrating on this? Why not something about how it is computed?

It is simple. You want to know about the various ranges of credit scores because they come from different companies. Each of them use varying computations. If you want to know if you have a high score or not, you have to understand where it will be coming from.

What are the 8 ranges of credit score

First of all, you may be wondering, why do we have so many credit score ranges anyway? According to the explanation from CreditKarma.com, it all began with just one – the FICO score. It is the reason why this remains to be the most popular model for computing credit scores. The FICO score was developed by Fair Isaacs Company back in the 1970’s to standardize the credit decisions done in the financial industry. Over the years, other credit score companies adapted the original algorithm from the FICO model and created their own by improving it as they see fit. The main runners in these improvements and credit score variations come from the three major credit bureaus – TransUnion, Experian and Equifax.

So what are the popular credit score ranges that you need to know about? Make sure to familiarize yourself with these because what you don’t know about your credit score can hurt you.

Fico Classic Score (300 to 850)

This score is developed by the Fair Isaac Company. This is one of the three type of scores that can be availed from this company. The higher the score is, the better it will be for the consumer. This is usually availed by lenders from the three credit bureaus while consumers typically go directly to Fair Isaac. This is the most popular range there is – even with other companies. It is typically used by credit card companies, lenders (auto, mortgage and student loans), banks, insurance companies, credit unions and other financial companies.

FICO Industry Option Score (250 to 925)

Obviously, this is another score coming from the Fair Isaac Corporation. Just like the Classic, this score is also sold to lender through the three major credit bureaus. However, this is not available to be directly availed by consumers. Those who get this score are usually the auto lenders and creditors from credit card companies – although there are lenders who avail of this too.

Fico NextGen Score (150 to 950)

This is the last of the three credit score ranges that is provided by the Fair Isaac Corporation. Just like the Industry Option, this is available to lenders through the 3 credit report agencies (credit bureaus) but it is not available to consumers directly. The primary user of this are credit card companies but other lenders can also look at this score.

VantageScore (1.0 and 2.0: 501 to 990) and (3.0: 300 to 850)

This was the old version of the VantageScore that is provided by VantageScore Solutions. The three credit bureaus actually invested in this because they wanted an alternative to the FICO Score. This score has an unusual range and according to the company, it required lenders and creditors to change some of their rules. That is the main reason why a lot of them opted not to use it. In fact, only 10% use this for their lending decisions. The 3.0 is the new version of the VantageScore that was only recently released in 2013. Lenders get their credit scores from the three credit bureaus but only Equifax and TransUnion make it available to consumers. Most financial institutions use this already when making their lending decisions.

TransUnion Risk Model (300 to 850)

This used to be known as TransRisk. Obviously, this was developed by TransUnion and unlike the previous credit score ranges, this is only available through this company. Consumers can avail of this score through other sites as long as they are owned or affiliated with TransUnion. The main clients of this score are credit companies, debt collection agencies, auto lenders, insurance companies and most large banks.

PLUS Score (330 to 830)

Experian developed this score and surprisingly, this is not made available to lenders. The main clients of this credit score are the consumers themselves. The main purpose of this score is to educate consumers and help them improve their scores. They can avail of this score through websites owned or affiliated with Experian.

Experian National Equivalency Score (360 to 840)

This is another score that is developed by Experian and it can be availed by lenders through them alone. For consumers, they can avail of this credit score but only through the Credit Sesame website – for free. Most financial lending and credit institutions avail of this but they are also joined by lawyers, property management companies and even the federal government.

Equifax Credit Score (280 to 850)

As the name carries it, Equifax developed this credit score and lenders can avail of this with them. It is also available to consumers through Equifax too. The company is secretive as to who uses it but it can be assumed that financial institutions use it for variety.

Regardless of the company computing your credit score, it is important to note that all of them refer to the same source – your credit report.

What does a high credit score mean?

When you are trying to buy a home and you have a low credit score, you know that it will cost you a low interest rate. So the main purpose of knowing all of these data is to eventually improve and maintain a high credit score.

But what exactly does a high score mean?

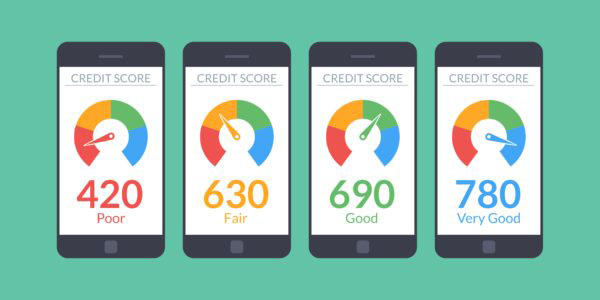

Based on the infographic from Credit, the FICO score of 680 and above is a good score. It will allow consumers to get a 4.2% on a housing loan. In fact, the median score in the US is right 723 – a bit above this range. If the score of the consumer is 740 and above, that is considered as excellent. It can land them a 3.9% on their mortgage rate. The lowest range of score at 300 to 550 means the consumer will get a 9.5% on their home loan.

Obviously, with the varying credit score ranges, you know that the “high” requirement will vary among them. For instance, the 800 score of PLUS Score may not be good enough for a FICO NextGen Score – since their ceiling is until 950. You have to consider where your score is being taken from so you can understand how you can improve it.

So before you can really start working on your credit score, know the company that computed it so you will know where it falls under the credit score range it is taken from.