If you’re one of the many millions of Americans who have problems getting credit because of a low credit score, there is good news.

A new VantageScore

There is a new credit-scoring model that could boost your credit score. It could even help if you have little or no credit history. This new model will be used in the latest version of VantageScore, which is the credit score that was created by the three credit reporting bureaus – Experian, Equifax and TransUnion.

Why this is different

Previous to this, if you had a debt that went into collection it would factor into your credit score for seven years. However, the new version of VantageScore won’t factor these into your score – assuming you paid the debt in full or as long as the balance is zero. In addition, people who suffered from a natural disaster such as the hurricane Sandy, who are making their payments on time will continue to be shielded against negative accounts.

Who’ll see their credit reports improve?

In addition to those consumers who were the victim of a natural disaster, millions of other people who have paid collection accounts are likely to see their scores improve. VantageScore has said that if you have a zero balance on collections and no other negative information in your credit report, you should see your credit score improve significantly.

Only your VantageScore

Unfortunately, you’ll see a boost in your credit score only if your lender uses VantageScore. This change will have no affect on your FICO score, which is still the most widely used touring model. However, VantageScore is gaining ground on the FICO score. In fact six of the top 10 companies that issue credit cards and four of the top auto loan and mortgage lenders are now using VantageScore.

Rent and utility payment records to be included

Another big difference is that this new model will also weigh utility payment records and rent and public records such as bankruptcies for people who have very limited credit histories. There are roughly 30,000,000 people who have not been able to get credit scores to date and this will probably help them qualify for both a score and more competitive credit rates.

Aligning itself with FICO

VantageScore is now aligning its scoring with that of FI CO so they will range from 300 to 850. While this is about the same as changing your speedometer from miles per hour to kilometers, it should make more sense for American lenders and consumers.

FICO is also changing

Meanwhile, FICO has said that it’s going to start looking into ways to factor in alternative records for calculating credit scores for people who are without or have very limited credit files.

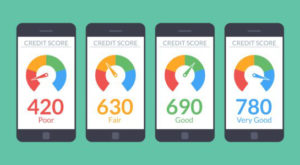

What’s your score?

You know your credit score? If you don’t, you need to learn it. Whenever you apply for credit, the first thing the lender will do is check your credit score. If you have what’s considered to be a good credit score (750 and above), you’ll most likely get the credit that you applied for. But if your score is 580 or less, you may find it difficult to get new credit. And if you are able to get that loan or credit card, it will likely come with a much higher interest rate.

How to get your credit score

You can get your VantageScore from any of the three credit reporting bureaus. However, the only way to get your FICO score is at www.myfico.com. You can get it free by signing up for a free 10-day trial of the company’s Score Watch program.