Of all the stresses we endure in life, almost every one of us is thinking about our finances, pretty much all the time. And if we are struggling with credit card debt, those stresses can grow tenfold.

Then there are those of us who are already experiencing a mental health issue. Life is challenging on a daily basis and financial difficulties accentuate the struggle. Your past-due bills act as the icing on an already unappetizing cake.

It’s no wonder debt affects our mental health and vice versa. According to a double-opt-in survey of 2,000 Americans commissioned by National Debt Relief and conducted by OnePoll, being in debt not only increased their anxiety but also affected their retirement plans and marital status.

The Effects Of Debt On Mental Health

From coming between your relationships to withdrawing from life, debt affects your mental health in so many ways. Beyond the obvious damage it can have on your financial health, daily stresses over debt spread like tendrils across your mental stability, weeding their way into all that we are and do.

The problem with being in massive debt is that once you start down the slippery slope of not making payments on time, or even at all, avoidance becomes a way of life. This can affect your overall well-being, as reported by a National Debt Relief survey that discovered people on average lose over 200 hours of sleep per year over their debts. But it’s not only your rest that suffers.

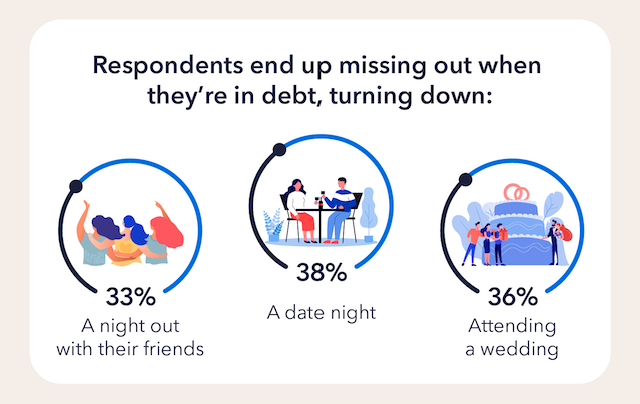

According to the poll results, 69% of respondents said they withdraw from things they love due to long-term exposure to a negative stimulus like constant stress, anxiety, and moodiness that can all too easily lead to mental health problems.

The longer you carry any kind of debt, the worse your mental health can deteriorate. Some scenarios include you are working off a student loan or you and your family have a 30-year mortgage payment on a new home.

Or maybe you live with the inevitable fear of your personal debt growing way beyond your ability to pay it off. Reports say that becoming sick and incurring high medical bills can keep someone in debt for a lifetime. This unexpected debt can quickly snowball and keep you from doing the things you love.

Trying to motivate yourself to tackle your debt by finding a debt relief plan is a difficult task, but it can also mark the beginning of the end of your financial stress.

People Also Read

Can You Get Debt Written Off Due To Mental Issues?

Whether or not your lender/creditor or their collection agency may consider negotiating your debt could come down to a few factors:

- How much you owe

- How long you have owed it

- The severity of your mental health issue

- How debilitating your situation is

- Your current employment status

The less you owe, the more likely a creditor won’t waste their time chasing you down or shooting your debt to a collection agency. You could call your creditor, plead your case and come out ahead. If the amount you owe is small enough (especially if you have already made some payments towards it), you could even get it expunged.

Waiting out the debt

It’s common knowledge in debt collection that the longer a debt goes unpaid, the harder it is to collect. “Waiting out the debt,” as it is called, is a dangerous game to play. Depending on how much you owe and the policy of a collection agency or your creditor, your debt could get reported to a credit bureau after some time.

Creditors and collection agencies are generally sympathetic to people with debilitating mental illnesses. Again, the level of that sympathy is not guaranteed, and each creditor and collection agency is bound by their specific guidelines. You might find your creditor/collection agency willing to help by:

- Putting your debt on hold for a prescribed period

- Agreeing to only contact you in specific ways and at certain times

- Allowing you extra time to gather more information related to the debt

- In the case of your creditor, agreeing to hold off sending your account to a collection agency

- Enlisting a specialist who works in the field of mental health to work with you directly

Some creditors will take you at your word when you alert them to your mental health issue and help you plan for dealing with what you owe. For others, you might need to show medical evidence of your current mental health condition. Sometimes all you need is a copy of a recent prescription or a letter from a healthcare provider.

How To Mentally Deal With Debt

As anyone would advise, the best way to deal with debt is to pay it off. But debt management is not always easy, especially when you are not up to the task. The best way to mentally deal with your debt is to create a clear vision of what you are up against by making a list.

Figure out a budget

If you are capable or if you can enlist someone to help you, get a handle on what you spend weekly. This would be a good first step to addressing your debt and mental health. Consider the income coming in compared to the money going out. This will provide a clearer picture of where you might be spending frivolously. Put that extra money to better use by making payments towards your debt and consider budgeting.

Know your rights

Did you know?

- A debt collector cannot usually contact you before 8 AM or after 9 PM your local time.

- A collector probably can’t call you at work unless you have told them they can do so.

- Your lender and a collection agency both need to provide you with an itemized statement of your bill when you ask for it.

- If a creditor calls and gets your voicemail, they have restrictions on what messages they can leave that they are calling about. Typically, they can only leave their name and the name of their company.

These and many more guidelines protect you by law under the Fair Debt Collections Practices Act. You do indeed have some rights even though you rightly owe some money. There are plenty of debt relief options you can explore and choose the best path to help you resolve your debt and take this weight off your shoulders.

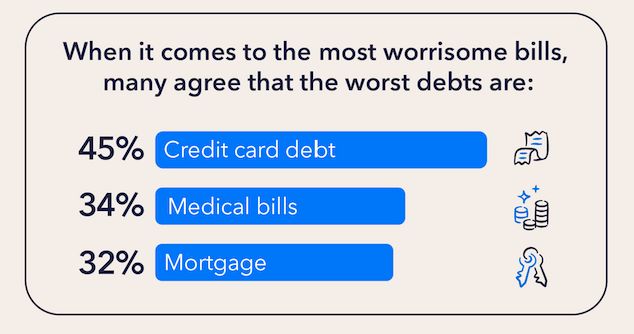

Learn that not all debt is the same

‘Secured debts —car loans, your mortgage, etc. —are almost always connected to an asset. These debts need to be addressed and paid in full first so that you don’t risk losing them.

Dealing with your ‘unsecured debts’ is where you have more wiggle room. For instance, did you know that medical debt takes the longest time to be flagged on a credit report? Especially if you are undergoing regular medical treatment for a mental health issue, you need to be vigilant about your medical debt.

You can address all other debt, which may be considerable and mounting, with each of your creditors. Discuss payment plans, negotiate down your debt, or request a lower interest rate.

Some Ways To Cope With Debt

Almost all financial advice starts with this #1 rule; pay off your debt as soon as you can. But for too many of us, ‘as soon as you can’ is far down the road.

Individuals with mental health concerns are not the only people challenged with debt, and facing it is vital. By opening the last collection letter you ignored, you could take the first step towards better coping with your situation.

That call to a lender/creditor, or even a collection agency might surprise you. Rehearse exactly what you are going to say, what kind of a payment plan you could adhere to, and what details of your mental health issue you are going to offer…if any.

Negotiating on your behalf

If you have a caretaker, you could also have them look through your paperwork and even call the creditor on your behalf. Of course, you would have to first identify yourself and explain why you are giving someone your proxy.

If you have endured a mental health issue for a long time, you might be assigned a caseworker or even an attorney. They, too, can contact a creditor on your behalf.

Awareness of mental health issues has grown tremendously over the past few years. Better laws, newer programs, and advances in therapy and pharmaceuticals have made it easier for people suffering from mental illness to find the support they need.

Quite simply, your creditor wants you to pay the bill you owe; they do not want to give it to a collection agency where they will surrender a percentage of the balance owed. Retail collection agencies do have restrictions around how they can approach a debtor, especially someone who can prove a mental health issue.

For those under the double stresses of debt and mental health concerns, these are just some of the ways to make your life more manageable.

Debt Help Takeaways:

- Face the debt with a budget considered

- Learn precisely the amount you owe and the kind of debt it is

- Consider a payment plan for some of your bills

- Enlist someone to help you wade through the paperwork and be your point person of contact for your creditor

- Advise those you owe money to of your mental health issue

- Learn more about how a debt relief company works to help you resolve your debt

All of this and more will undoubtedly bolster your financial health and ease your mind. But you can’t afford to ignore your debt and live a life of stress. You need to act now.

Survey methodology:

This random double-opt-in survey of 2,000 Americans was commissioned by National Debt Relief between December 13 and December 15, 2021. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).