Veteran Debt Relief

As you readjust to civilian life, it’s not uncommon to encounter financial challenges. We’re here to help the transition go smoother.

You served us. This guide will show how we can serve you.

A new strategy for your financial situation

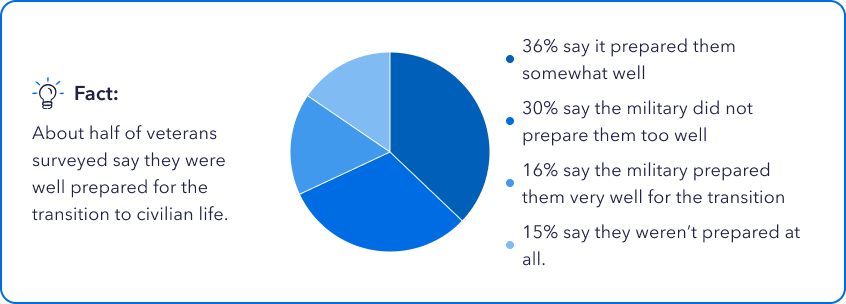

You dedicated your life to serving our country, and we thank you for your service. As you reintegrate into civilian life after separation, you lose military and tax benefits. To add insult to injury, finding a job can pose challenges. The last thing you need is an overwhelming amount of debt during this time of transition.

A lack of income could put you in a financial hole and lead to hardship trying to cover the essentials like rent, food, and utilities. You can rely on financial assistance and grants or find the right option to resolve your debt once and for all. Debt relief can help you pay your creditors and provide a fresh start outside the military.

As if establishing a career or finding a job isn’t enough of an undertaking, you are also responsible for expenses once covered by the military. So, even a small gap in employment between active duty and civilian life can cause a domino effect on your finances. Below are the most common causes of financial struggles after leaving the military. Don’t get down on yourself, these struggles are through no fault of your own.

Moving Expenses

Even though the military offers relocation benefits, moving costs can easily surpass that amount. If you don’t have the cash to pay upfront, a loan for veterans might be your only option. But this is a band aid solution that will add to your debt.

New living costs

As a civilian, you’ll need to purchase your own insurance coverage and housing. You’ll also pay more for food if you don’t have convenient access to a commissary. These higher living costs require money and if you’re on a limited income, the funds might not be there to tap into.

A lower ability to work

If you arrive home with a physical or mental disability, the trials and tribulations of civilian life are tenfold by limiting your ability to meet certain job requirements. If you can’t work a full-time job or can only manage a part-time role, your earnings could fall short and not cover all your expenses. Many employers look to accommodate veterans but if your ability to perform is limited, your earnings will be too.

Relying on a fixed income as a veteran

If the end of your military service takes you to the beginning of retirement, you’ll have a fixed income to cover your living expenses. But the amount might not be enough to pay for the lifestyle you envision. Unless you supplement your income, you might not be able to cover essential expenses.

A spouse is unemployed

Since frequent relocation can hold your spouse back from keeping a consistent job, their rate of unemployment tends to be high. As a result, military families often live on one income – yours.

If you’re a service member for any of the US Military branches and need assistance with debt repayment, we can help you explore your options. Why face the burden of debt alone when you can have the support from a team that caters to your unique needs?

As a veteran, you’re entitled to distinct advantages not available to the civilian population. Therefore, it’s important to mention your military standing before creating a repayment plan. While you’re exploring your options consider various solutions, such as debt consolidation, debt management, and veteran debt relief programs. Each has its own pros and cons for your financial needs. Without the help of a debt repayment program, paying off your debt could take years, or even decades.

Debt Relief

Debt relief is an umbrella term that refers to a variety of strategies that make it easier for you to repay your creditors. No matter which option you choose, you’ll typically pay less than you owe and in a shorter amount of time.

Debt settlement

Using this method, an expert will negotiate on your behalf with creditors to reduce the amount you owe. The next step is to set up affordable monthly payments to pay off the rest. You could become debt free in as little as 24-48 months. If you don’t have an income and can’t save money, you won’t qualify. But don’t worry, there are other options to consider.

Debt consolidation

A debt consolidation loan takes all your credit card and other qualified debts and combines them into a single loan with one monthly payment. You can save with a lower interest rate, which in turn reduces your monthly payment. Combining everything into a single payment can be especially beneficial if you are juggling credit card bills or lines of credit from multiple lenders with varying interest rates. By making your outstanding debt easier to manage, you’re also in a better position to pay it off in a shorter amount of time.

Personal Loans

Whether you need money for a big purchase like a home improvement project or you’re looking to consolidate credit card debt, you can save money with exclusive financing options. Private lenders offer special considerations to veterans and active-duty members, including low-interest rates and optimal loan terms. Lenders are receptive to this debt repayment option since the loans can be partially backed by the Department of Veteran Affairs.

Shopping around is a tried-and-true method for finding the best solution. Consider the interest rates, monthly payments, and the time it will take to repay the balance before you apply.

Unsecured loans for veterans

When you leave active duty, unsecured loans for veterans offer flexible options for you to regain control over your finances. Whether the debt accumulated when you were deployed or you’re juggling unexpected costs now that your service has ended, help is available.

An unsecured loan is offered through a private lender, and many are available for almost any purpose (some do dictate how you use the money.) The biggest benefit of this type of loan is you don’t need to guarantee it with collateral. On the other hand, a secured loan like a mortgage or auto loan must be secured by high-valued property. If you default on the loan, the lender sells the property to recoup their money.

You can save with a cap on interest rates and optimal payment terms through special programs designed to financially protect service members.

Options for unsecured loans include:

- A signature loan

- Personal line of credit

- Credit card balance transfer

You can take out this loan from a bank or credit union simply by providing your income, credit history and signature.

Similar to a credit card, you draw the amount you need from the available balance, and only pay interest on that amount.

A credit card that lets you transfer balances from other accounts. Most of the time, balance transfer credit cards offer consumers an introductory 0% APR — or zero interest — on their balance for a limited time (usually between 12 and 21 months). Be sure you can pay off the debt before the introductory rate expires and the interest skyrockets.

Public Service Loan Forgiveness

Veterans and active-duty service members might qualify for Public Service Loan Forgiveness. Under this program, borrowers can have their loans forgiven after working ten years for an eligible non-profit organization or government agency and making 120 qualifying monthly payments.

If you don’t fit the criteria but still can’t afford to repay your full debt balance—even with smaller monthly payments over time—you can request a waiver (debt forgiveness). The VA may grant one for part or all your debt. If they do honor your request, you won’t have to repay the amount they agree to forgive.

Submit these two items to request a waiver:

- A Financial Status Report (VA Form 5655)

- A personal statement that explains why you feel you shouldn’t have to repay the debt. In your statement, share more information to support your waiver request. This should be new information that you haven’t provided in writing and isn’t already in your VA records. You can also ask for an oral hearing.

As a military member, you have access to assistance programs aimed at helping you overcome financial hurdles.

The military debt relief act

Officially known as the Servicemembers Civil Relief Act, it sets regulations for interest rates on loans offered to active-duty military members, including those in the Air Force, Army Marine Corps, Coast Guard, Navy, National Guard, and reserves. The relief and protections offered also apply to a spouse and children of a qualified service member. Affordable interest rates are available for:

- Auto loans

- Student loan

- Credit cards

- Cell phone service contracts

- Mortgages

In addition, when a person is deployed, landlords are required to allow service members break their lease without penalty.

- The Military Lending Act

Puts a cap on interest costs for credit products. - The Veteran’s Housing Benefit Program

Provides low-rate loans to help veterans access affordable housing. - Veteran’s financial assistance loans

Provides access to good mortgage financing options when purchasing a home. - Veterans of Foreign Wars (VFW)

The VFW helps military families through its Unmet Needs program. Families who are experiencing financial difficulties can receive grants of up to $1,500 to help pay for basic living expenses. 1-866-789-6333

Financial aid for veterans wounded in active duty

The organizations below offer financial assistance for veterans through grants and stipends that can be used for living expenses and medical treatments. If you sustained injuries while serving, these veterans assistance programs offer ways for you to find healing and help without going into debt.

USACares

The Military Assistance Response program provides assistance for veterans bills due to a military service incident. The goal is to create long-term stability by improving the quality of life.

Operation First Response

This Family Assistance Program lends wounded veterans financial assistance as they go through the VA claim process. The funds help veterans cover basic needs such as clothing, rent, groceries, car payments, and more.

888-289-0280

Semper Fi & America’s Fund

This Fund is committed to providing veteran financial assistance and support to wounded, ill, and injured members of all branches of the U.S. Armed Forces. Their Service Member & Family Support program offers financial help with housing, transportation, bedside and caregiver support – to name a few.

760-725-3680

Veterans Affairs Life Insurance (VALife)

This new program provides guaranteed acceptance whole-life insurance coverage to Veterans ages 80 and under with any level of service-connected disability.

Veteran financial assistance programs for female veterans

Females currently make up about 11% of the veteran population, according to Pew Research Center. But that number is due to increase to 18% by 2046. While the above programs cater to both men and women, the following programs are designed to help female veterans.

- Combat Female Veterans Families United (CFVF United)

Provides financial assistance for female veterans through transition, education, and advocacy initiatives. Combat veterans who are transitioning back to civilian life can find help with basic living expenses through the organization’s emergency financial assistance. 919-637-7679 - Dixon Center

Offers one-time grants through their Women Veterans Emergency Financial Assistance program to female veterans and their families who are experiencing financial hardship. The grants for veterans can be used to cover the cost of everything from gas and work training to housing costs. 877-369-0938

Organizations that help homeless veterans

Veterans currently make up about 1/3 of the adult homeless population, according to We Honor Veterans. If you’re a homeless veteran looking for help, the organizations below can help you pay your bills and more.

- Veterans Inc

This housing program assists veterans in finding local housing, going through employment training, getting legal and medical advice, and more. An application for housing can be quickly and easily done through their website, or you can call for details. 800-482-2565 - U.S. Department of Housing and Urban Development(HUD-VASH)

This program helps veterans across the country find permanent housing through a combination of HUD housing vouchers and veterans affairs services. Check out the VA programs for homeless veterans for more information. 877-424-3838 - Modest Needs Foundation

This nonprofit recognizes the challenges that veterans may face after returning to civilian life. Their Homecoming Heroes Grant can help with either rental assistance or be used to cover a one-time emergency expense. The goal of this grant is to prevent veterans from entering poverty after returning home from deployment.

American Red Cross

The American Red Cross offers confidential services to you and your family. They can connect you with local, state, and national resources through their network of chapters in communities across the United States and offices on military installations worldwide.

Every day, they provide 24/7 global emergency communication services and other support in military and veteran health care facilities around the world. Services range from responding to emergency needs for food, clothing, and shelter, referrals to counseling services (e.g., financial, legal, jobs, mental health), and other resources.

If your family needs emergency assistance, you may contact the American Red Cross by submitting a request online, using their FREE mobile app, or calling them at 1-800-733-2767 seven days a week.

Debt can have a cumulative effect over time. As you reintegrate, there’s a good chance you’re already experiencing rising interest costs, late fees, and increasing debt balances. These debts can get out of control, making it hard to even keep up with minimum payments. National Debt Relief can help you determine the best way to solve your financial struggles as you begin shaping the post-military life you deserve.

During your free consultation, a debt specialist will determine a timeline and your monthly payment amount to settle your debts. You will immediately begin depositing that monthly payment into an FDIC-insured dedicated savings account in your name. Most clients become debt free in as little as 24-48 months.

Once a debt has been settled, we will contact you for approval and ask that you release the funds. If you lack the money to settle all your debts, we offer a payment program that enables you to make just one monthly payment to National Debt Relief. As the funds build up, we use the money to pay your creditors.

National Debt Relief is accredited with an A+ rating by the Better Business Bureau and belongs to the American Association for Debt Resolution — the watchdog of the debt settlement business. To be a member of this Council, we have pledged to treat our clients with transparency, honesty, ethics, and fairness.

To learn more about how National Debt Relief can help you take back your life, call 800-300-9550 or complete the no-obligation debt consultation form today. We promise to support you every step of the way, just like we have done for over 500,000 people across the country.

“National Debt Relief put together a plan that I could follow and afford. If I just kept making minimum payments it would’ve taken 40 years to pay off.”

At the core of our client relationships is one simple factor: trust. We know that trusting anyone with your finances takes a leap of faith, and we live up to your expectations by providing our undivided attention. That way, we can better identify your goals and concerns before customizing an affordable plan that can save you the most money.

National Debt Relief is the first debt settlement company to be accredited by the Better Business Bureau with an A+ rating, the American Association for Debt Resolution, the Internal Association of Professional Debt Arbitrators, and rated #1 on Consumer Affairs. We are proud to be the country’s only debt relief provider to enjoy recognition from these three important organizations.

Our Commitment To Customer Care Leads The Industry

We will always act in your best interest and our reviews reflects that promise:

- Over 75,000 5-star reviews from clients who have taken back control of their finances

- 4.83 out of 5 rating on TrustPilot

- Rated #1 for debt consolidation by:

- What does the VA consider a financial hardship?

If you’re struggling due to life situations like losing your job, a sudden decrease in income, or having an increase in out-of-pocket family health care expenses, you can request financial hardship assistance to manage your current VA copay debt or request an exemption from future copays.

- What financial benefits are available from the VA?

VA benefits include disability compensation, pension, education and training, health care, home loans, insurance, Veteran Readiness and Employment, and burial.

- Why would the VA deny my benefits?

According to the Veteran Affairs website, 75% of all first-time applications are denied due to incomplete information, the lack of necessary documentation, or not enough evidence to support your disability.

- Can I make too much money to receive VA disability benefits?

Your current finances do NOT play a role into whether you will be approved for benefits. There are no income restrictions to receiving VA disability benefits, which means it is impossible to make too much money to receive benefits.

- I have already obtained one VA loan. Can I get another one?

Yes, depending on the circumstances. Normally, if you have paid off your prior VA loan and disposed of the property, you can have your used eligibility restored for additional use. Also, on a one-time only basis, you may have your eligibility restored if your prior VA loan has been paid in full, but you still own the property. To obtain eligibility, you must send a completed VA Form 26-1880 to their Atlanta Eligibility Center.

To prevent delays in processing, it is also advisable to include evidence that the prior loan has been paid in full and, if applicable, the property disposed of. This evidence can be in the form of a paid-in-full statement from the former lender, or a copy of the HUD-1 settlement statement completed in connection with a sale of the property or refinance of the prior loan.

- What is the maximum amount of a VA loan?

Although there is no maximum VA loan amount (limited only by the reasonable value or the purchase price), lenders will generally use your credit score and ability to repay the loan as guidelines.

- What is the 55 year rule for VA disability?

Once you turn 55, you will no longer require an exam to prove your condition has not changed unless there is reason to suspect fraud. This is sometimes called the 55-year rule.

- What VA disabilities are considered permanent?

Certain types of service-connected disabilities are automatically deemed to support a VA rating of Permanent and Total Disability. They include the irreversible loss of use of both hands, both feet, one hand and one foot, loss of vision in both eyes, or being permanently bedridden.

Something really exciting happens after people have their first phone call with us.

They immediately feel a sense of relief knowing they have a plan to get out of debt.

Pay off your credit card debt

- Receive A Free Savings Estimate Today

- See How Quickly You Can Be Debt Free

- No Fees Until Your Accounts Are Settled