When Judy lost her husband to cancer, her world turned upside down. Suddenly, she had to handle everything—grief, bills, and a mountain of credit card debt—on her own.

“When my husband suddenly passed away, I was left with the responsibility to pay the debts,” Judy said. “We had a lot of credit cards. I tried to pay them, but it was not possible with one income.”

Finding Her Way After Loss

Judy’s husband passed away just four months after being diagnosed. She continued working and qualified for survivor benefits through Social Security, but it wasn’t enough to keep up. “I got to where I didn’t want to answer the telephone because I was so nervous,” she recalled. “I knew what it was, and I was raised not to lie. So when I’d say, ‘I’ll send you some money,’ I knew I wasn’t going to because I didn’t have it—and that just drove me nuts.”

Her debt wasn’t from overspending—it came from trying to stay afloat after losing half her household income. Before long, the balances on her nine credit cards totaled more than $20,000.

Taking the First Step Toward Relief

One night, Judy saw a National Debt Relief commercial on TV. “I don’t know why—I think the good Lord told me to call you,” she said. “One phone call is all it took. I am now debt free. No more dreaded phone calls.”

That decision, she says, changed everything. “It changed my life, it truly did,” Judy explained. “I could go to the grocery store a little bit more. I could get gas in my car.” Just as important, the constant anxiety started to fade. “The phone calls quit, and that gave me good health,” she said. “I didn’t mind answering the phone anymore because I knew it wasn’t one of them.”

Staying the Course Through Challenges

Even while enrolled in the program, Judy faced setbacks. A tornado tore through Bowie, Texas, damaging her roof and uprooting a tree in her yard. “I was lucky enough simply to have to replace the roof,” she said. “The good Lord was looking out for me.” Despite the unexpected expense, she stayed committed. “I didn’t think I was going to make it through the program at one point,” she admitted. But with encouragement and support from National Debt Relief, she decided to keep going—and she’s grateful she did.

A Moment to Celebrate

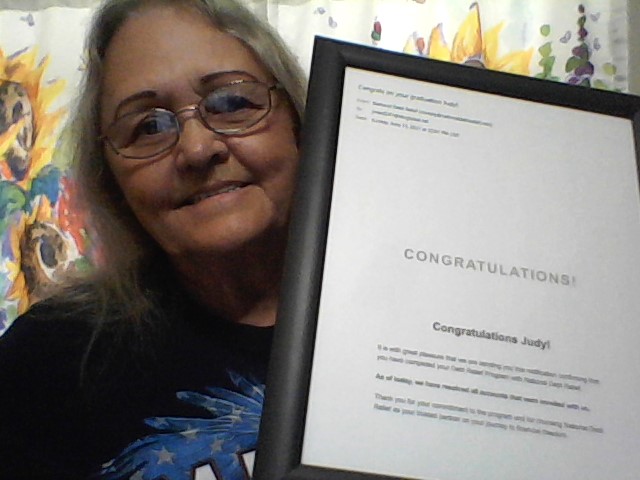

After five years in the program, Judy graduated in 2021, having settled $20,617 in credit card debt. “I was so excited. I couldn’t believe it,” she said. The moment meant so much that she framed her graduation certificate and still keeps it proudly displayed at home. “There is only one thing I regret,” she said, “and that is not calling National Debt Relief sooner!”

Enjoying Life on Her Terms

Today, Judy lives a quieter, more stable life surrounded by her fur babies and her garden. She sticks to a monthly budget and enjoys having a little extra left over each month. “I do what I want to do,” she said. “I just want to stay with my fur babies. I do all my gardening outside, do all my mowing and weed-eating—and that’s what I like to do.”

She still doesn’t spend on extras and prefers to save for unexpected costs, like home repairs or property taxes. But the difference now is peace of mind. “I’m not supposed to have any extra money,” she said with a laugh. “So it’s really nice when I do.”

Her Advice to Others

Judy doesn’t hesitate when asked what she’d tell others in debt: “Pull the trigger and call National Debt Relief,” she said. “They will take care of it, and they will take care of you. There’s not anybody else better.”