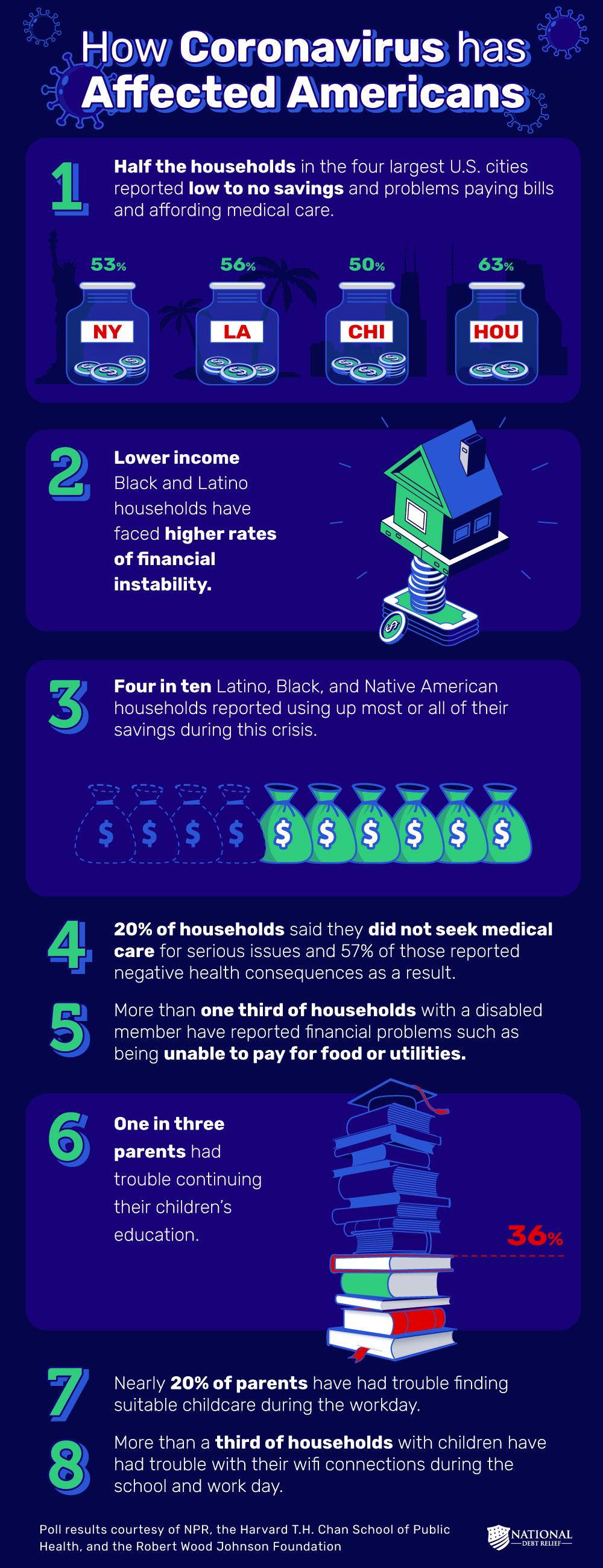

Coronavirus has affected Americans across the nation, with many households feeling the effects of the economic downturn. There have been numerous calls to change the systems and policies that have caused certain communities to feel the effects of the pandemic at higher rates. These communities are facing financial struggles such as paying rent, credit card bills, loans, and utilities on a reduced income.

In a five-part series of polls conducted by NPR, the Harvard T.H. Chan School of Public Health, and the Robert Wood Johnson Foundation, researchers interviewed 3,454 adults 18 or older across the United States between July and August of 2020 before the termination of federal coronavirus support programs. “The Impact of Coronavirus” takes a hard look at the growing economic problems due to the pandemic and the vulnerable households in need of aid.

The effects of the pandemic are ongoing, and many Americans are struggling to find relief. This has raised concerns as to the nation’s ability to withstand prolonged health and financial difficulties. The numbers reported from this poll support the demand for more preventative measures and policies that protect households from these situations.

Americans need help now more than ever with growing debt due to this pandemic. Now is the perfect opportunity to take control of your finances by having a budget, lowering bills, and taking on side gigs for extra cash. Every bit helps!