Medical Debt Relief

Medical debt is the most common form of debt on Americans’ consumer credit reports, according to the Consumer Financial Protection Bureau. Given the rising cost of health care and the difficulty many people encounter finding adequate and affordable insurance coverage, this type of debt is a problem many Americans will face at some point in their life.

If you are living under the shadow of medical debt, the expenses can feel overwhelming and insurmountable—especially since costly procedures and hospital stays often arise from unexpected events. No matter what, you should never delay seeking the treatment you need due to financial reasons. Instead, consider these debt relief options to pay off your debt.

How To Prevent Medical Debt From Taking Over Your Life

Good news. You now have one year before medical debt in collections will appear on your credit report. You can use this extra six months to work with providers or collectors to negotiate or pay off your debt. And in 2023, the three consumer credit reporting agencies will no longer include medical debt under $500.

While you now have more time to pay off your medical debt before it hits your credit score, your score is still in jeopardy after it is sold to a medical collection agency. By dealing with this issue before your payment is considered late, you can protect yourself from major stress, late fees, and a lower credit score.

How To Manage Your Medical Bills

If you can’t fully pay a medical bill on time, the steps below can stop medical collection agencies in their tracks:

- Check with your insurance company

Read the terms of your insurance policy carefully and then contact them to ensure you are responsible for the charge.

- Negotiate the amount you owe

Believe it or not, medical bills are often negotiable. Contact your medical provider to discuss your financial situation and try to lower the amount. Get any agreed-upon arrangement in writing to avoid any future discrepancies.

- Try working out a repayment plan

Your health care provider might be willing to let you pay your bills in monthly installments, which can make it more manageable. Be aware that any interest or fees the provider charges will be tacked onto the cost of the original bill.

- Hire a billing advocate

A medical billing advocate can sort through your bills and try to negotiate a settlement with health care providers and insurance companies on your behalf. Since up to 80% of medical bills contain at least one mistake, there is a good chance the advocate could find that you already paid the bill, you are being charged an incorrect amount or that you are being billed for services you never received. This service isn’t free, but there is a good chance it will save you time and money.

- Seek financial assistance

Depending on your income, you could qualify for financial assistance with:

-

- Medicaid

- Local or state programs

- Religious groups

- Nonprofit organizations

- Charities

- Use a credit card as a last resort

If you run out of options, you might need to use your credit card. But it is important to note that you will incur interest on the amount you charge and don’t pay in full. You could also lose assets like your car or home if you secure the loan and default.

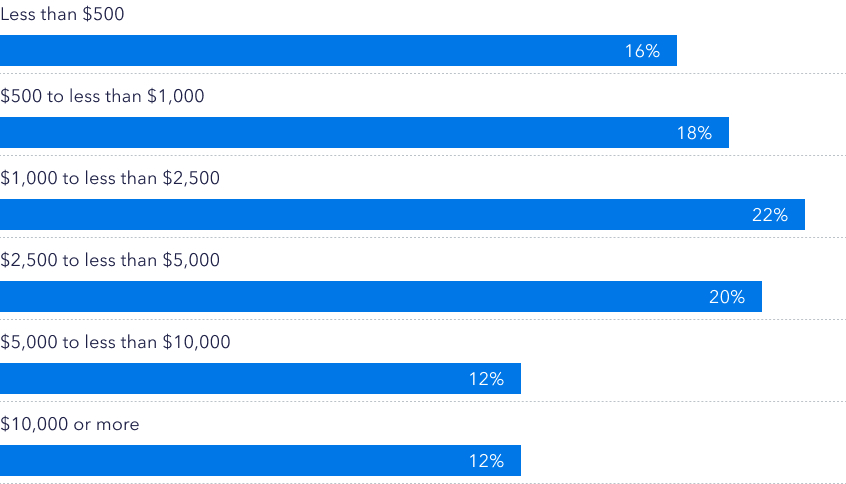

Nearly a quarter of people with Medical debt owe between $1,000 and $2,500

Even if a medical procedure or hospital stay is unexpected, being proactive and asking the right questions upfront can help you avoid overwhelming debt.

- Ask how much your insurance will cover

- Record everything

- Don’t assume your medical bill is correct

- Negotiate the amount of your bill

- Seek financial assistance

- Don’t use your credit card to pay for part of a medical bill

You wouldn’t buy a car without knowing the exact price, so why take a chance with your medical bills? If you have time beforehand, call your insurer and ask what will be covered before getting a procedure. If something is not covered, ask if there are alternative treatments. Of course, emergencies are an entirely different story.

Make a folder and use it to keep every medical bill statement, explanation of benefits (EOB) and message you send or receive from your insurance company. The EOB is an important document that includes a detailed list of costs, what your insurance covered and what you are responsible to pay.

Check each bill carefully to ensure that the procedure and provider are correct. If you don’t recognize a charge, checking the date can help you recall the appointment. Be aware that some providers might bill you under their associated hospital. If you can’t remember the doctor visit, call the provider to confirm it. If an expense seems unusually high, question its accuracy. Don’t be afraid to ask questions, mistakes happen!

Hospitals and the doctor’s office would prefer to receive some money rather than sending it off to collections. Call and ask if your bill can be reduced to an amount that is manageable for you. If you have a number in mind, suggest that amount. The worst they can say is “no.” You can also suggest paying off your bill in monthly installments. Most billing departments will work with you.

Even if you are covered by medical insurance, a planned procedure can surprise you with exorbitant out-of-pocket costs. And if you receive care from an out-of-network provider, you could be responsible for the total bill. Fortunately, many hospitals offer financial assistance programs to help patients cover their medical expenses. In addition, there are nonprofit organizations that provide assistance for chronic health conditions like cancer. You can find a state-by-state list of more than 100 financial assistance programs across the country at the U.S. Department of Health and Human Services (HHS).

Paying for your medical bill with a credit card should be your absolute—you have no other way to pay—last resort. To start with, you will lose your eligibility for a payment plan. It is also a risky strategy if you can’t cover the monthly balance in full because the high interest could greatly increase the cost in the end.

Studies have shown that about 1 in 5 emergency room visits will result in a surprise bill.

In the past, you could be surprised after a hospital visit with a bill by a provider who was out-of-network – even if the hospital was in network. Anesthesiologists and emergency room doctors were the biggest culprits. As a result, people were often responsible for thousands of dollars they never planned on paying, which forced them into debt.

The No Surprises Act protects people who seek care with an in-network hospital from being billed without their consent for any out-of-network services by:

- Prohibiting providers and facilities from directly billing patients for the difference between the amount charged and the amount their coverage paid

- Requiring providers and facilities to provide good faith estimates of charges for uninsured individuals while scheduling care or upon request

- Protecting uninsured individuals through a patient-provider dispute resolution when the charges vary greatly from the estimate

- Limiting the amount billed if a provider switches networks during an individual’s treatment

Heads up

Like most things, even the No Surprises Act has loopholes. Out-of-network providers may present you with a form labeled “Surprise Billing Protection Form.” Signing it waives your protections and instead provides consent for your treatment to be billed at out-of-network rates. Insist on seeing the full form before you ever sign anything.

If you need urgent care and you are forced to sign the form, you can fight the out-of-network charges after treatment:

- Write on the form that you are “signing under duress” and note the problem

- Take a photo of the form after you add comments

- Call your insurer or the provider before you pay a cent

- Use the federal hotline (1-800-985-3059) or website to report violations

Who is eligible for the No Suprises Act

Individuals enrolled in private or commercial health coverage are covered, including:

- Employment-based group health plans (both self-insured and fully insured)

- Individual or group health coverage on or outside the Federal or state-based exchanges

- Federal Employee Health Benefit (FEHB) health plans

- Non-federal governmental plans sponsored by state and local government employers

- Certain church plans within IRS jurisdiction

- Student health insurance coverage

Nearly 3 in 10 insured adult Americans had a medical debt over $500 that was sent to a collection agency, according to a Consumer Reports. The same survey found that 24% had no idea they owed the bill, and 13% said they never received the medical bill.

If you discover that a medical bill was sent to a collection agency, don’t pay it until you are 100% certain that you legally owe the money. By knowing what to ask yourself and the collection agency, you could end up with a lower bill or even no bill at all.

What is the statute of limitations?

The statute of limitations refers to the amount of time an individual or company can file a legal action. For medical debt, the time limit varies from state-to-state.

| State | Written Contracts | Oral Contracts | Promissory Notes | Open-ended Accounts |

|---|---|---|---|---|

| Alabama | 6 | 6 | 6 | 3 |

| Alaska | 3 | 3 | 3 | 3 |

| Arizona | 6 | 3 | 6 | 3 |

| Arkansas | 5 | 3 | 5 | 5 |

| California | 4 | 2 | 4 | 4 |

| Colorado | 3 | 3 | 3 | 3 |

| Connecticut | 6 | 3 | 6 | 3 |

| Delaware | 3 | 3 | 3 | 3 |

| D.C. | 3 | 3 | 3 | 3 |

| Florida | 5 | 5 | 4 | 4 |

| Georgia | 6 | 4 | 4 | 4 |

| Hawaii | 6 | 6 | 6 | 6 |

| Idaho | 5 | 4 | 4 | 4 |

| Illinois | 10 | 5 | 5 | 5 |

| Indiana | 6 | 6 | 6 | 6 |

| Iowa | 10 | 5 | 5 | 5 |

| Kansas | 5 | 3 | 5 | 5 |

| Kentucky | 15 | 5 | 10 | 5 |

| Louisiana | 10 | 10 | 10 | 3 |

| Maine | 6 | 6 | 20 | 6 |

| Maryland | 3 | 3 | 12 | 3 |

| Massachusetts | 6 | 6 | 6 | 6 |

| Michigan | 6 | 6 | 6 | 6 |

| Minnesota | 6 | 6 | 6 | 6 |

| Mississippi | 3 | 3 | 3 | 3 |

| Missouri | 10 | 6 | 3 | 5 |

| Montana | 8 | 5 | 5 | 5 |

| Nebraska | 5 | 4 | 5 | 4 |

| Nevada | 6 | 4 | 3 | 4 |

| New Hampshire | 3 | 3 | 6 | 3 |

| New Jersey | 6 | 6 | 6 | 6 |

| New Mexico | 6 | 4 | 4 | 4 |

| New York | 6 | 6 | 6 | 6 |

| North Carolina | 3 | 3 | 3 | 3 |

| North Dakota | 6 | 6 | 6 | 6 |

| Ohio | 8 | 6 | 6 | 6 |

| Oklahoma | 5 | 3 | 6 | 5 |

| Oregon | 6 | 6 | 6 | 6 |

| Pennsylvania | 4 | 4 | 4 | 4 |

| Rhode Island | 10 | 10 | 10 | 10 |

| South Carolina | 3 | 3 | 3 | 3 |

| South Dakota | 6 | 6 | 6 | 6 |

| Tennessee | 6 | 6 | 6 | 6 |

| Texas | 4 | 4 | 4 | 4 |

| Utah | 6 | 4 | 4 | 4 |

| Vermont | 6 | 6 | 14 | 6 |

| Virginia | 5 | 3 | 6 | 3 |

| Washington | 6 | 3 | 6 | 6 |

| West Virginia | 10 | 5 | 6 | 5 |

| Wisconsin | 6 | 6 | 10 | 6 |

| Wyoming | 10 | 8 | 10 | 6 |

- Does the statute of limitations excuse you from responsibility?

- Should you ask to see an itemized bill?

- Are the dates and providers correct?

- How long do I have to dispute the debt?

- What’s the best way to overcome medical debt?

Before you pay an outstanding medical bill, it is important to determine exactly when the service or procedure was performed. If it is longer than the state’s statute of limitations where you were treated, you may be able to get a debt collection lawsuit thrown out of court. Please note that even if the law excuses you from paying the debt, it could still impact your credit score for 7 years.

Yes! Don’t just assume the bill is correct. Ask for an itemized bill and comb over every single charge, especially if it is for a hospital stay. You might find a procedure you didn’t have or a medicine that was never prescribed. For example, you could have several charges for physical therapy when your hospital stay was for a kidney stone. If something doesn’t sit right with you, call your provider or insurance company.

After you have carefully looked over the charges, check to see if the dates and providers are correctly listed. This can be especially important for hospital stays when several specialists could visit you on any given day.

It is important to act immediately on a medical debt you believe is incorrect or invalid. You only have 30 days to dispute it, according to the CFPB, and the countdown legally begins the day you receive notification from a debt collector. Once you dispute the debt, the collector can’t call or contact you until they have verified the debt for you in writing. But remember, if you don’t dispute the debt within 30 days, the collector has every right to assume it is valid.

Medical debt consolidation (also called negotiation) is a good resource to deal with medical debt, especially if you have multiple creditors and accounts to handle. A debt relief company can help you negotiate your balances and combine it into one loan. This makes paying off your balances more manageable with a single monthly payment at a lower monthly amount. You can also save money with a lower interest rate and by avoiding additional charges for late fees and other costs. With the right financial plan, you can eliminate the stress of paying for health costs and focus on what matters most: getting healthy and remaining that way.

During your free consultation, a debt specialist will determine a timeline and your monthly payment amount to settle your debts. Most clients become debt free in as little as 24-48 months. You will immediately begin depositing that monthly payment into an FDIC-insured dedicated savings account in your name.

Once a debt has been settled, we will contact you for approval and ask that you release the funds. If you lack the money to settle all your debts, we offer a payment program that enables you to make just one payment a month to National Debt Relief. As the funds build up, we use the money to pay your creditors.

National Debt Relief is accredited with an A+ rating by the Better Business Bureau and belongs to the American Association for Debt Resolution — the watchdog of the debt settlement business. To be a member of this Council, we have pledged to treat our clients with transparency, honesty, ethics, and fairness.

If you have a minimum $10,000 in unsecured debt, National Debt Relief could help you take back your life. We promise to support you every step of the way, just like we have done for over 500,000 people across the country.

Something really exciting happens after people have their first phone call with us.

They immediately feel a sense of relief knowing they have a plan to get out of debt.

Pay off your medical debt

- Receive A Free Savings Estimate Today

- See How Quickly You Can Be Debt Free

- No Fees Until Your Accounts Are Settled